Mattel Reports Q2 2015

For the second quarter of 2015, Mattel, Inc., reported flat worldwide net sales in constant currency, adjusted operating income of $23 million, and adjusted earnings per share of $0.01.

“In the second quarter, we made solid progress as we work to return Mattel to improved growth and profitability,” said Christopher Sinclair, Mattel chairman and CEO. “Our financial results in the quarter largely met our expectations, and we are encouraged by improved performance across our core brands, as well as strong momentum in emerging markets like China and Russia. Although we are still early in our turnaround effort, I believe we are taking all the right steps to be more competitive in the growing global toy industry.”

Financial Overview

For the quarter, worldwide net sales were flat in constant currency compared to last year. In the North American Region, which consists of the United States, Canada, and American Girl, second quarter gross sales decreased 2 percent in constant currency, and 3 percent as reported. In the International Region, gross sales increased by 5 percent in constant currency, and decreased 10 percent as reported. Adjusted gross margin increased 70 basis points as adjusted and 150 basis points as reported. Adjusted other selling and administrative expenses increased 70 basis points of net sales, and 30 basis points as reported. Adjusted operating income for the quarter was $23 million, compared to prior year’s adjusted operating income of $38.1 million. Mattel’ debt-to-total capital ratio as of June 30, 2015, was 45 percent.

Cash flows used for operating activities were approximately $241 million, compared to approximately $79 million in 2014. Cash flows used for investing activities were approximately $161 million, a decrease of approximately $364 million, primarily due to the prior-year acquisition of MEGA Brands. Cash flows used for financing activities and other were approximately $269 million, compared to cash flows from financing activities and other of approximately $83 million in 2014. The change was primarily driven by prior-year net proceeds from net long-term borrowings, partially offset by prior-year share repurchases.

Capital Deployment

The board of directors declared a third quarter cash dividend of $0.38 per share, which is flat compared to the third quarter of 2014. The dividend will be payable on September 18, 2015, to stockholders of record on August 26, 2015.

Sales by Brand

Mattel Girls and Boys Brands

For the second quarter, worldwide gross sales for Mattel Girls & Boys Brands were $601.8 million, down 3 percent in constant currency versus the prior year. Worldwide gross sales for the Barbie brand were down 11 percent in constant currency. Consistent with the first quarter, year-to-date retail sales for Barbie are up slightly on a global basis, driven by strong performance in the United States, partially offset by a decline in international markets. Worldwide gross sales for Other Girls brands were down 6 percent in constant currency. Worldwide gross sales for the Wheels category, which includes the Hot Wheels and Matchbox brands, were up 26 percent in constant currency. Worldwide gross sales for the Entertainment business, which includes Radica and Games, were down 16 percent in constant currency.

Fisher-Price Brands

Second quarter worldwide gross sales for Fisher-Price Brands, which includes the Fisher-Price Core, Fisher-Price Friends, and Power Wheels brands, were $336.8 million, up 9 percent in constant currency versus the prior year.

American Girl Brands

Second quarter gross sales for American Girl Brands, which offers American Girl-branded products directly to consumers, were $84.2 million, up 1 percent versus the prior year in constant currency.

Construction and Arts & Crafts Brands

Second quarter gross sales for Construction and Arts & Crafts brands, which includes the MEGA Bloks and RoseArt brands, were $64.8 million. Mattel acquired MEGA Brands, Inc., on April 30, 2014.

Hasbro Reports Q2 2015

Hasbro, Inc., reported financial results for the second quarter 2015. Net revenues for the second quarter 2015 decreased 4 percent to $797.7 million versus $829.3 million in 2014. Excluding a negative $71.5 million impact from foreign exchange, net revenues increased 5 percent.

Net earnings for the second quarter 2015 were $41.8 million, or $0.33 per diluted share, compared to $33.5 million, or $0.26 per diluted share, in 2014. 2014 net earnings included an unfavorable tax adjustment of $13.8 million, or $0.10 per diluted share.

“Our second quarter results continue a strong start to the year with good underlying momentum in our Franchise and Partner brands across geographies,” said Brian Goldner, Hasbro’s chairman, president, and CEO. “The execution of our brand blueprint strategy, including our recent decision to sell our final manufacturing locations and the continued development of new relationships in content development, furthers the transformation of Hasbro into an organization focused on global brand building. We are well positioned for the remainder of 2015, but importantly we continue to develop our capabilities for the long-term execution of our strategy toward unlocking the full potential value of our brands.”

Deborah Thomas, Hasbro’s CFO added, “Our second quarter results came with numerous challenges, including a significant negative foreign exchange impact and difficult year-over-year comparisons in several brands. Even with these challenges, we delivered a strong second quarter and a good first half of 2015. We continue to make important investments across our business to promote brand initiatives and to further improve the global efficiency of Hasbro. Some of these investments will be more prominent in the second half of 2015 than they were in the first six months of the year.”

Second Quarter 2015 Major Segment Performance

U.S. and Canada Segment net revenues increased 1 percent to $385.2 million compared to $383 million in 2014. The Segment’s results reflect growth in the Boys and Preschool categories. The U.S. and Canada Segment reported operating profit of $47.1 million, essentially flat with $46.9 million in 2014.

International Segment net revenues were $362.8 million compared to $396.8 million in 2014. Growth in the Preschool category was more than offset by declines in the Boys, Games, and Girls categories. On a regional basis, growth in Latin America was offset by declines in Europe and Asia Pacific. Emerging markets revenues declined 11 percent in the quarter. Excluding an unfavorable $69.5 million impact of foreign exchange, of which approximately two-thirds of the impact was in Europe and the remainder in Latin America, net revenues in the International Segment grew 9 percent and approximately 9 percent in emerging markets. The International Segment reported operating profit of $25.4 million compared to $29.2 million in 2014, which was also negatively impacted by foreign exchange.

Entertainment and Licensing Segment net revenues were $47.6 million compared $47.7 million in 2014. Segment performance was driven by entertainment-backed licensing revenues. The Entertainment and Licensing Segment reported a decline in operating profit to $7.4 million compared to $14.6 million in 2014. This decline was primarily due to digital gaming expenses, including the final quarter of amortization expense from certain digital gaming rights.

Second Quarter 2015 Product Category Performance

Second quarter 2015 net revenues in the Boys category increased 1 percent to $340.4 million. This growth was driven by year-over-year revenue gains in Hasbro franchise brand Nerf, as well as shipments in support of Jurassic World and growth in Marvel and Star Wars products. These increases more than offset the anticipated decline in Transformers, which faced difficult comparisons versus the 2014 shipments in support of the theatrical release of Transformers: Age of Extinction.

Games category revenues declined 6 percent in the quarter to $211.6 million. Magic: The Gathering declined in the quarter as the major set release occurred in the first quarter 2015 versus the second quarter 2014. Over the first six months of the year, Magic: The Gathering revenues increased. Additional revenue declines in Duel Masters and Angry Birds products were partially offset by gains in franchise brand Monopoly as well as in several other games brands including Trouble, Clue, and Twister.

The Girls category revenues declined 22 percent in the second quarter 2015 to $127.5 million. Furby was the leading driver of this decline, along with smaller declines in franchise brands My Little Pony and Nerf Rebelle in the quarter. Growth in Play-Doh DohVinci and shipments of Disney Descendants partially offset these declines.

Preschool category revenues increased 14 percent in the second quarter 2015 to $118.1 million. Growth in franchise brand Play-Doh and shipments of Jurassic World more than offset revenue declines in core Playskool products.

Dividend and Share Repurchase

Hasbro paid $57.4 million in cash dividends to shareholders during the second quarter 2015. The next quarterly cash dividend payment of $0.46 per common share is scheduled for August 17, 2015, to shareholders of record at the close of business on August 3, 2015.

During the second quarter, Hasbro repurchased approximately 311,465 shares of common stock at a total cost of $21.6 million and an average price of $69.41 per share. Through the first two quarters, Hasbro repurchased 747,312 shares of common stock at a total cost of $46.8 million and an average price of $62.64 per share. At quarter-end, $517.3 million remained available in the current share repurchase authorization.

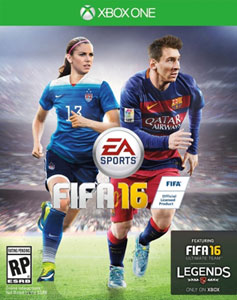

Women Take the Pitch in EA Sports FIFA

Electronic Arts, Inc., announced that U.S. Women’s National Team Forward, Alex Morgan, and Captain of the Canadian Women’s National Team, Christine Sinclair, will be the first women to appear on an EA Sports FIFA cover. Morgan shares the FIFA 16 cover spotlight with global soccer sensation, Lionel Messi, in the United States and Sinclair shares the cover with Messi in Canada. For the first time in franchise history, women will take the pitch in EA Sports FIFA. Fans will be able to represent 12 Women’s National Teams in FIFA 16, in Kick Off, an Offline Tournament, and Online Friendly Matches.

Electronic Arts, Inc., announced that U.S. Women’s National Team Forward, Alex Morgan, and Captain of the Canadian Women’s National Team, Christine Sinclair, will be the first women to appear on an EA Sports FIFA cover. Morgan shares the FIFA 16 cover spotlight with global soccer sensation, Lionel Messi, in the United States and Sinclair shares the cover with Messi in Canada. For the first time in franchise history, women will take the pitch in EA Sports FIFA. Fans will be able to represent 12 Women’s National Teams in FIFA 16, in Kick Off, an Offline Tournament, and Online Friendly Matches.

FIFA 16 will be available starting September 22, 2015, in North America on EA’s Origin service on PC, Xbox One, Xbox 360, PlayStation3 and PlayStation4.

Mickey, Baseball Promo Underway

The #TeamMickey All-Star Baseball Tour is underway. Fans can join the promotion during three weekend games in 2015: Atlanta Braves at St. Louis Cardinals (7/26), Boston Red Sox at Detroit Tigers (8/9), San Diego Padres at Colorado Rockies (8/16). At each game, attendees will enjoy Mickey Mouse-themed activities, an on-field celebration, giveaways, and surprises throughout the day.

The #TeamMickey All-Star Baseball Tour is underway. Fans can join the promotion during three weekend games in 2015: Atlanta Braves at St. Louis Cardinals (7/26), Boston Red Sox at Detroit Tigers (8/9), San Diego Padres at Colorado Rockies (8/16). At each game, attendees will enjoy Mickey Mouse-themed activities, an on-field celebration, giveaways, and surprises throughout the day.

Each team offers a ticket package available for purchase now, which includes a limited edition co-branded Mickey Mouse hat from New Era as well as Mickey Mouse-themed entertainment.

In addition, fans are invited to enter a national sweepstakes for a chance to win a trip for a youth baseball team of up to 15 people to visit the ESPN Wide World of Sports Complex at Walt Disney World Resort and play in a select baseball tournament. Visit www.Disney.com/teammickey.

What’s New in Pet Gear on TTPM

In addition to Pet Toys, TTPM has expanded into Pet Gear. Here are some of the latest offerings. For the latest reviews in Toys, Tots, Pets, and More visit TTPM.com.